By Jeff Paul

By Jeff Paul

*This article is from the April, 2017 issue of our premium newsletter.

Finding affordable, safe, comfortable housing can be a challenge particularly during a time of rising housing costs, mass underemployment, and high student debt. These factors combined with the simultaneous ascent of the freelance and sharing economies are fueling a growing trend of co-living.

For some it is out of financial necessity; for others it is a strategic lifestyle choice. In either case, more people across the globe find themselves in co-living situations. This trend is creating opportunities for those who want “access” to amenity-rich housing without the hassle and cost of ownership, and for real estate entrepreneurs who can deliver on that promise.

I’m a digital nomad (location-independent Internet entrepreneur) and real estate investor who spent several years traveling around the world with my family before recently returning to mainland USA. When living out of backpacks, we had one simple bill for lodging that included everything from comfortable furnishings, clean linens, electricity, water and sewer, TV service, Internet, basic toiletries, garbage removal and housekeeping, to sometimes even breakfast. You may not be surprised to find out that it was less stressful and cheaper to live in a hotel or Airbnb rental in Central America or Southeast Asia than owning or leasing a home in suburban America.

Having separate bills for all those services every month is costly in time and money. In my experience, it was much simpler to pay a flat rate for all-inclusive lodging than worry about maintaining all those accounts. Access over ownership is a growing trend unto itself, and is at the foundation of the co-living trend.

Access is Displacing Ownership

The value of owning something is that you have immediate access to using or enjoying that thing. But there is a cost to ownership. Just ask anyone who owns a boat or has a self-storage unit full of mediocre furniture and other easily replaceable junk. Today, technology has allowed instant access to many big and small things that used to require ownership.

Why buy a car when you have cheap, easy, quick access to a personal chauffeur at Uber or Lyft? Why buy a summer home on the lake when you can jump on Airbnb and book the perfect cabin for 1-2 months with none of the headaches of owning a second property? Same for boats, RVs, tractors, etc.

But those are the big things. Don’t forget those huge entertainment centers that filled your living room with a box TV and a stereo with cluttered DVD or CD collections. Now the TV fits in your hand and services like iTunes, Netflix and Amazon Prime give you instant streaming access to practically all music, TV shows and movies.

These developments of subscription-based access and the Uberfication of idle resources will change how homes are designed and how people will live together. Effects from technology changes aside, economic conditions are also changing how we live together.

Economic Conditions Driving Co-Living Trend

The key economic factors that appear to be driving the co-living trend are inflated housing costs, underemployment, and high student debt combined with the simultaneous rise of the freelance and sharing economies.

While living and traveling in developing nations I also noticed that it was common to see three generations living in a single household. Grandma takes care of the grandchildren and keeps the home so the productive generation can go to work. Incidentally, economic necessity in these cultures creates a strong family bond. This is how America used to be when it was “developing” and how it still is for many immigrant families.

Given the rocky road that the current U.S. economy is on, this deliberate co-living model may provide more abundance and less debt than what has been sold as the traditional American Dream. Yet not everyone has family to shack up with, so they’re seeking the unique options you’ll see below.

First, here’s a bit more background on the key economic factors that are driving this co-living trend.

Rising Rents

As the cost of housing continues to inflate in America, under-employed Millennials with crippling student debt cannot qualify for mortgages and often find themselves forced to live with family or several roommates.

According to a recent report, rents have risen by about 22% in Southern California:

House rents averaged $3,114 a month in Orange County during the fourth quarter of 2016, according to Irvine-based HomeUnion, a firm that helps investors buy and rent out houses in about a dozen markets across the nation.

That’s up 22 percent, or $561 a month, over the past four years, vs. a 13 percent increase for apartment rents during the same period, figures from Reis Inc. show.

Los Angeles County’s average rent of $2,548 a month last quarter was up 22.1 percent over the past four years, compared with a 21.7 percent gain in apartment rents over the same period. In the Inland Empire, house rents increased 23 percent to $1,729 a month, vs. a 17 percent increase for apartments in the same four-year period.

The median household income in LA County is around $56,000, before taxes, or about $4000 take-home pay per month. The average rent of $2,548 from above is around 64% of wages. And Southern California is a microcosm of what is happening in many other cities in America and around the world.

In Silicon Valley, high-paid tech workers are turning to communal living to cope with high rents. According to a recent Reuters story:

Zander Dejah, 25, pays $1,900 a month rent to live in a downtown San Francisco house with at least 40 other people, many of whom sleep in bunk beds.

Dejah is a resident of The Negev, a communal living space that styles itself as a home for millennial tech workers to brainstorm ideas, write code and create apps, even if they have to share toilets and bathrooms with dozens of others.

More on this community in the next section; Interesting Co-Living Projects.

Underemployment

As indicated above, wages in LA County are not rising nearly fast enough to keep up with the inflation of housing costs. And those are the fortunate people with jobs. Underemployment is a growing problem for Millennials as well as people working in particular industries that are susceptible to the approaching tidal wave of automation.

According to a 2016 survey reported by Forbes, a whopping 51% of Millennials reported being “underemployed,” up sharply from 41% in 2013. Another media survey showed that 64% of Millennials would rather make $40,000 a year doing something they love instead of making $100,000 per year at a job they think is boring.

All of this is encouraging Millennials into more simple lifestyles and flexible work in the gig economy. But they’re not alone in this struggle.

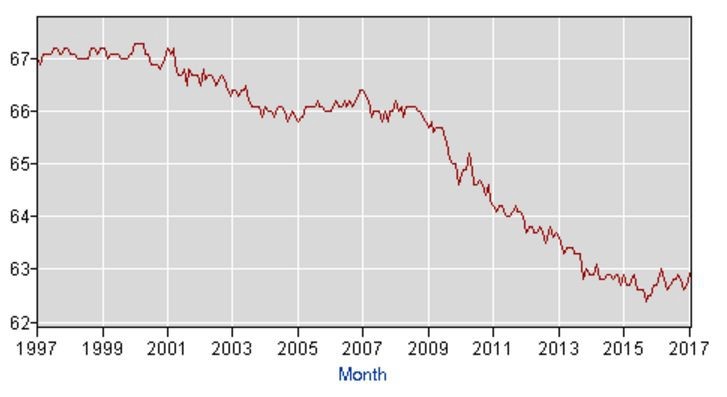

Labor force participation rates have been on a steady decline for the last two decades. See the 20-year chart from the Bureau of Labor Statistics:

Civilian Labor Force Participation Rate – Bureau of Labor Statistics

Civilian Labor Force Participation Rate – Bureau of Labor Statistics

Part of me wants to believe that fewer people in the workforce is a good thing. Perhaps it’s a lifestyle choice for some, like a stay-at-home parent, but most of the 37% of capable adults who are not traditionally employed are likely suffering financial difficulties.

High Student Debt

Millennials are the generation that is supposed to be buying starter homes right now, but they’re unable to due to high student debt. Combined with limited employment options, this debt is paralyzing. And, increasingly, they’re defaulting on this debt.

In 2016, a record 1.1 million students defaulted on their student loans, making 10% of total people with student loans in default.

According to the US Department of Education as reported by CNBC,

42.4 million Americans owed $1.3 trillion in federal student loans. More than 4.2 million borrowers were in default as of the end of 2016, up from 3.6 million in 2015. In all, 1.1 million more borrowers went into or re-entered default last year.

To make matters worse, when they default they reduce their chances of getting a job or qualifying for other financing, says Rohit Chopra, a senior fellow at the Consumer Federation of America and a former student loan ombudsman at the Consumer Financial Protection Bureau.

People who have defaulted on their student loans “are going to have a tougher time passing an employment verification check, saving for retirement or ever buying a home,” Chopra said. Borrowers in default can also have their wages garnished and their tax funds seized.

No doubt the threat of getting their wages garnished is also contributing to the rise of freelance and other under-the-table work.

Freelance Economy Meets the Sharing Economy

Counter Markets continues to highlight opportunities for independent contractors in the peer-to-peer economy because it represents such an epic shift in how the economy is organized. And it also empowers individuals who are ready to take their destiny into their own hands.

Today, if there’s a way for you to provide value to others, there’s probably an app to connect you directly to customers. For instance, you can move to a new city without a traditional job and immediately make money driving for Uber, or dog walking, tutoring, babysitting, or fixing things for people who find you on Task Rabbit…and much more.

Having location independence is incredibly liberating. However, it can mean living far away from family. Making new friends and finding comfortable co-living situations in new locations is difficult. That’s the problem being solved by the projects in the next section.

Interesting Co-Living Projects

The co-living trend is manifesting in many different ways. More adults are living at home with their parents. Some have gotten rid of their useless crap and have joined the tiny house movement or RV communities as a simpler alternative to the American Nightmare of working 60-hour weeks to pay off debt. Others are renting fully furnished rooms with common gathering spaces by the month, week and even by the day offered by clever startups.

All seem to be inspired by a higher quality of life with fewer belongings and fewer responsibilities. They’re choosing freedom over debt slavery and experiences over things. A few entrepreneurs are attempting to serve people who are swept up in this trend.

Check out the three remarkable co-living projects:

The Negev

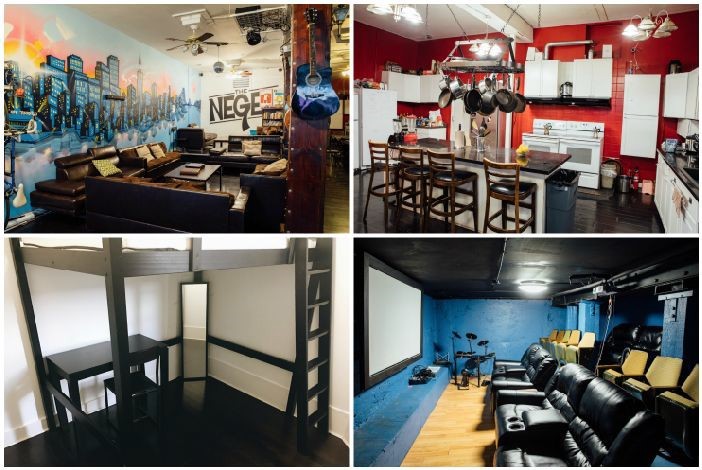

The Negev, whose tagline is “Live with Friends,” is a communal living space for Millennial tech workers. The Negev has multiple locations in three cities; San Francisco, Oakland and Austin. Though they claim to provide “personality based housing”, they seem to have a tech startup incubator culture where residents brainstorm business ideas, write code and create apps.

Top is Negev’s 6th St location & below is Folsom house in San Francisco

They’re all basically large homes with comfortable furnishings and some nice. Sort of like the co-living incubator in the HBO show Silicon Valley.

Prices at The Negev’s three locations in San Francisco range from $1000-$1600 for a private bed, utilities, and shared communal spaces.

The Collective

The Collective in co-living and co-working space with its first location called Old Oak in West London, England. The facility can host over 200 young business professionals. Average age appears to be around 28, says the founder. The campus has plenty of amenities and things for them to do.

The shared recreation space at The Collective includes kitchens, lounges, theater, restaurant & bar, library, gym, laundry, game room, rooftop terrace and more.

Private space includes a bedroom, kitchenette and en suite bathroom. “Regular cleaning and linen changes are offered as standard in every room. There is even a dedicated concierge service on hand 24/7 to help with anything you might need,” says their website.

All of the larger units in The Collective Old Oak location are already SOLD OUT for nine months in advance. Some smaller private rooms are still available and renting for £230 to £280 per week ($288 to $350).

PodShare

PodShare is a membership based co-living space with dormitory style pods. Located in Los Angeles, PodShare has communal kitchen, bathroom, and spaces. Its theme, or culture, appears to be young singles and travelers living out of backpacks, much like a hostel. Average age seems to be 22.

Each pod has a fully made bed, TV, lamp, outlets, and a shelf. Guests get their own locker, food cabinet and fridge space, as well as access to community food.

In this excellent video by Fair Companies, the founder boasts that PodShare’s pilot location had a 94% occupancy rate which encouraged them to expand to more locations. They’re currently seeking collaborators and investors.

The computer system for PodShare’s membership model has a reputation system that encourages good behavior.

The computer system for PodShare’s membership model has a reputation system that encourages good behavior.

Prices range from $40/night for single to $60/night for a double bed with discounts for extended stays. Free clean towels and toiletries are provided.

Co-Living Opportunities

If you’re interested in reducing your living costs and are considering co-living, look to close family or friends first. That’s where you’ll find the most sustainable fit.

If that’s not possible, look to your interests. Successful co-living spaces will likely be the ones with a strong culture or theme – a place where tenants share common ideas and activities. Examples of culture to build a co-living spaces around could be organic farming or self-sufficiency, business, health, hobbies, music, art, philosophy, etc.

If you seek larger profit potential, location is key for any real estate endeavor. Cities with skyrocketing rent prices will obviously provide the largest opportunity for entrepreneurs seeking to tap this model. You may want to look at buying hotels and converting them to this model. Hotels have been on the decline since Airbnb exploded on the scene, which means you may have the chance to buy them much cheaper than previously.

Finally, these communities don’t have to be for-profit. Our agorist friend and contributor to Counter Markets, Derrick Broze, lives with several housemates in a home dedicated to growing food and helping their community. They share the workload and expenses to ease the burden and create more free time to enjoy.

There is no set model for co-living to be successful. If your ideal situation doesn’t exist yet, take advantage of this trend, and go out and create it.

Top image: Membership based co-living space PodShare in Los Angeles