By Kai Sedgwick

By Kai Sedgwick

When we think of the unbanked, we envisage citizens of developing nations who lack the means and documentation to obtain access. But you don’t have to be a Mongolian goat herder to find yourself financially excluded. In the West, relatively affluent citizens are having their banking services withdrawn suddenly and without warning. Their ‘crime’? Buying and selling bitcoin.

Also read: 10,000 American Cryptocurrency Owners Will Receive Warning Letters From the IRS

A 20-Year Banking Relationship Broken by Bitcoin

Banks, like politicians, are a necessary evil. Few people wax lyrical about them, but begrudgingly accept that they are an unavoidable part of civilized society. In the 20 years I’ve banked with Natwest, I’ve had plenty of cause to bitch about them. Their service is poor and their products inadequate, and like most of their kind, will have gone the way of print media in a decade, as better forms of money and better means of doing business render the banking system obsolete. In the here and now, though, I depend on my bank, because a man can’t live on crypto alone.

Banking is one of the few constants in our lives. Friends and employers come and go, but ever since opening an account in our formative years, we are prone to sticking with our bank through thick and thin. I was no different up until Wednesday, when my tenure with Natwest came to an abrupt end after they pulled the rug from under my feet, prompting me to rage quit. As a result, I no longer have a bank account, a resource that most people my age would not only take for granted, but would have toiled over for years to accrue a five-figure balance at minimum.

The story of my banking blockade isn’t tragic or deserving of sympathy. But it warrants telling nonetheless, for it will be familiar to a number of readers who have bought or sold bitcoin. If this can happen to me, it can happen to anyone.

A Plague on All Your Banking Houses

Like most people who work in the cryptoconomy, I have cause to cash out bitcoin for fiat sporadically to pay the bills. I’ve used Localbitcoins (LBC) for this purpose since 2013, typically selling a couple of hundred bucks at a time, with the buyer transferring the funds to my bank account. On occasions, I’ve had cause to sell higher amounts, but never enough to trigger money laundering checks or prompt awkward questions from the bank. I’m not that dumb. As a result, I’ve successfully completed hundreds of trades on LBC without triggering the involvement of my bank.

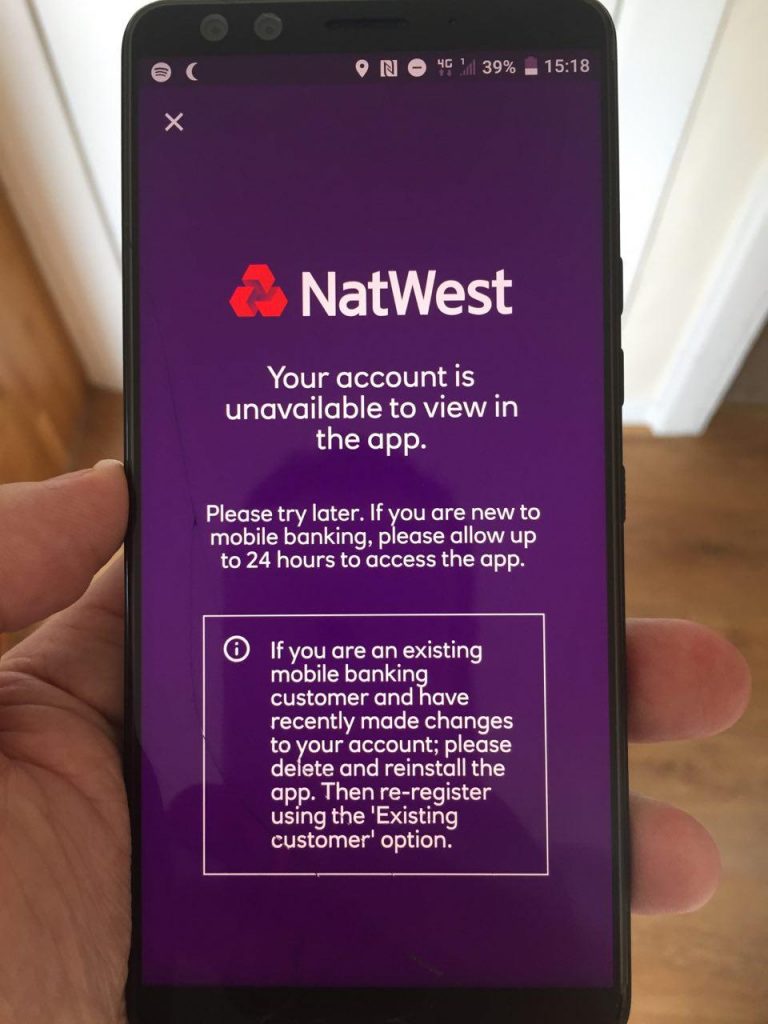

All that changed in an instant on Wednesday. I went to meet a mate for a drink, but when I tried to withdraw cash from an ATM, my card wouldn’t work. I went into the bar and tried to pay by card, asking the barman to run it through the machine before pouring my pint. It was also declined. Figuring Natwest’s entire banking system might be down (not everything runs as reliably as Bitcoin), I opened my mobile banking app, only to find I was locked out of that too.

As someone who works in cryptocurrency, I’m acutely aware of the risks posed by social engineering, and it was at this point that I glanced at the 4G symbol on my phone to check I hadn’t been SIM swapped. Mercifully, nothing seemed to be amiss there, but I was still without access to funds, and no closer to finding out why. As anyone who’s ever had their card blocked while abroad will attest, it induces a feeling of helplessness coupled with embarrassment at having your purchase declined. I wasn’t freaking out, but I was pissed off. Now I would have to phone my bank in a bid to find out what was wrong. I hate phoning people.

‘Suspicious Activity’

10 minutes of pre-recorded disclaimers and muzak later and I was connected to a telephone operator who confirmed that a block had been placed on my account, but they couldn’t inform me why – that would require transferring me to another department, with another dash of muzak while I waited, for good measure.

“Okay, so there’s been a block placed on your account because we’ve been asked to investigate two suspicious transactions dating from the third of May,” I was told. “There’s one for £1,000 and another for £8,000 with pay-in references … do you recognize these?”

A couple of points immediately stood out. Firstly, these incidents took place six weeks ago, and they’re only acting on it now? And secondly, I can’t even recall what I had for breakfast yesterday – how am I meant to recall two of the several hundred transactions to pass through my account since the start of May? Especially since I can’t log in and view the information pertaining to them, because I no longer have banking access.

Incidentally, losing your banking account doesn’t just cut off your funding: you also lose access to all the payment details you had stored for friends, direct debits, child support, car insurance and the rest. You have to message clients telling them not to pay into your account and friends requesting they resend their banking details. It’s a total ball-ache.

Bitcoin Is Bad, M’kay?

Based on the pay-in references the banking official reads off, I’m all but certain these are Localbitcoins sales, though I’ve no idea why they should have been flagged as suspicious. £1,000 isn’t remotely high enough to trigger AML checks, nor is it the highest amount I’ve ever cashed out. I refrain from mentioning the B-word to the banker, not because I fear the repercussions of admitting to trading bitcoin, but because it’s none of his god-damn business.

I have no idea who I sold those coins to – they were two pseudonymous usernames out of hundreds on LBC – and I don’t want to know either. I couldn’t care less whether the bitcoin I sold them was being used to purchase methamphetamine or depleted uranium: that’s none of my business. Moreover, even if I wanted to due diligence my counterparties, I would have no means of doing so. What I do know is this: the people I sold those coins to were regular LBC traders, who do this sort of thing day in, day out. As a result, the likelihood of those two transactions involving any sort of fraudulent or nefarious activity is extremely low.

I don’t tell any of this to the official on the other end of the line. Instead, I maintain my calm and point out the inconvenience of having my account shuttered without warning, cutting off all financial access. I point out that if the bank wanted to discuss these transactions with me, they have all my details – phone, address, email – and thus there was no need to freeze my account to get my attention. I then suggest that if they wish to obtain my assistance in investigating these “suspicious” transactions, restoring my account would be a good first step.

The employee tells me they can’t do that until I’ve complied with the request, and that’s when I politely tell him where to go. “We’re through.” I hang up the phone, and at that moment, my 20-year relationship with the banking world comes to an end. Sure, I could cooperate and beg for my account back, but that’s not my style. I have a problem with authority and being told what to do. Besides, how do you prove a negative, and show that a crime hasn’t been permitted? Fuck you Natwest and the horse you rode in on. Fuck you Natwest, Clydesdale, Wells Fargo and every other crumbling bank that thinks it can decide how its customers should spend their money. Your demise can’t come fast enough.

Thanks for reaching out to us. Unfortunately, Wells Fargo does not allow transactions involving cryptocurrency. -Josh

— Ask Wells Fargo (@Ask_WellsFargo) July 12, 2019

Same Shit, Different Customer

On the very same day that I was rage quitting on Natwest, I received a message from another LBC trader. He had no idea of the ordeal I’d just experienced, but had one of his own to share. “I feel like I’m being hounded by the banks,” he began. “Not only has my 20 year old halifax acc had a block put on it, but now my Revolut acc has been frozen with all my cash in there! Which bank, or fintech bank would you recommend using for this kind of business?”

I wasn’t in a position to recommend any banks, but I was interested in learning more about his predicament. He continued: “Revolut wanted me to explain where I got the 800 quid to start trading, I told them the truth – I sold a bike, an ipad. I then had to show them my trading history on lbc, then they asked for my tax statement(??), I told them I don’t have a tax statement, they then asked again!”

The intrusive and unreasonable questions didn’t stop there. Revolut proceeded to ask the guy why he had 50-100 BTC trading volume listed on his LBC account (which, for the record, is a low amount). He told Revolut that he was trading in an Asian country during the 2017 boom, before moving back to the UK, whereupon he decided to use what little money he had to try again. At this point, Revolut asked to see his residency permit for the country he’d been in. He explained that he wasn’t a resident there, and they asked him to produce his travel visa instead, which he reluctantly did. Revolut then said they would get back to him. Meanwhile, his account containing £800 remains suspended.

Unregulated peer to peer money is an existential threat to all governments.

Why? Simple. To govern is to control. Money that doesn’t allow centralized issuance or control strikes directly at this.

This fight has only begun.

Freedom money won’t be free.

— Palley (@stephendpalley) July 28, 2019

Frozen, Seized and Shuttered for What Exactly?

It’s hard to work out what any of this has to do with bitcoin – or to crime for that matter. Blackstone’s ratio famously holds that: “It is better that 10 guilty persons escape than that one innocent suffer.” The banks and their cronies – the governments and three-letter agencies including the IRS – would rather that 10 innocent people be criminalized than one guilty person should break the law. In the U.S., there are citizens currently facing jail for trading bitcoin. And we’re not talking about real crimes here, either: we’re talking about invented meme crimes like money laundering, which only exist because of a war on plants.

But I digress. The point of this lengthy diatribe is thus: until such a time as it’s possible to be out and proud about bitcoin, keep that shit schtum. Don’t mention it to your bank, hint at it, or receive a pay-in reference that could be in any way associated with it. Even if you do take all reasonable precautions, however, if you’re a frequent bitcoin trader, you’re liable to fall foul of the banking system sooner or later. When that happens, you’ll have two choices: grovel to have your account reinstated, or flip them the bird and take your business elsewhere.

As for me, I think I’m gonna go dark for a while. I’ll still sell coins on LBC and local.bitcoin.com, but I’m not clamoring to open another bank account any time soon. After 20 years, it feels strangely liberating to no longer be at the mercy of the banks. Bye, Felicia.

Have you experienced banking issues for buying or selling bitcoin? Let us know in the comments section below.

Images courtesy of Shutterstock.

Are you looking for a secure way to buy bitcoin online? Start by downloading your free bitcoin wallet from us and then head over to our Purchase Bitcoin page where you can easily buy BTC and BCH.

This article was sourced from Bitcoin.com