By Tyler Durden

By Tyler Durden

Even as apartment rents in Manhattan and San Francisco plunge for the first time in more than 10 years, millions of American millennials, burdened by debt, blinded by poor financial literacy and preoccupied with booking that first post-pandemic vacation still can’t ever imagine owning a home.

As for what the future holds, many would greet it with a genuine shrug: having children and buying homes is now something people – or, at least, men – do in their 40. As millennials postpone adulthood to focus on paying down their student debt, 30 has become the new 20, and while some might be tempted by the favorable market conditions, signing a lease on that spacious (for New York) Manhattan pad might not be the smartest move, from a fiscal standpoint.

Budget-conscious renters looking to take advantage of their newfound ‘WFH’-inspired flexibility might do well to consult this latest study from Hire a Helper, which explores the cities with the highest share of renters’ income going toward rent.

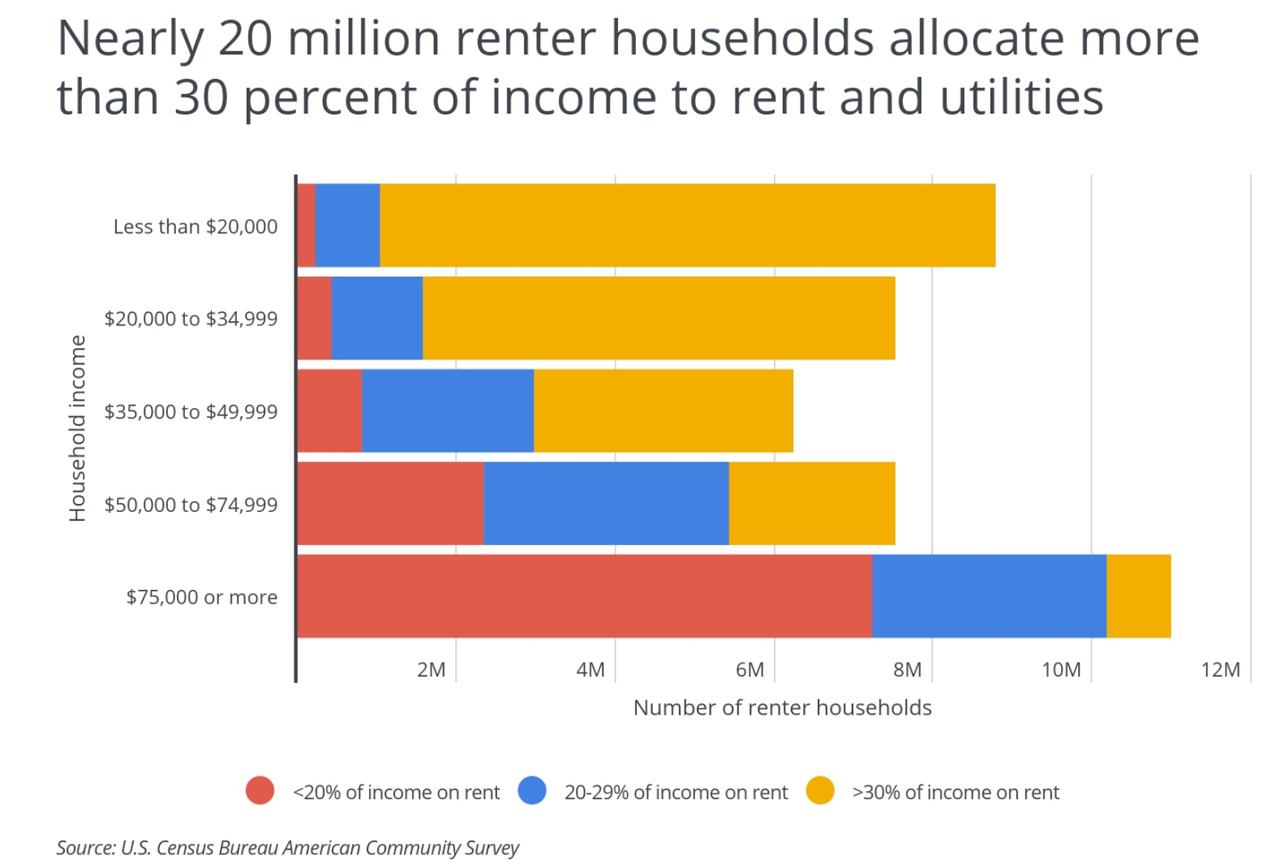

Across the US, 20% of renters spend more than 30% of their income on rent and utilities. Typically, financial planners say working people should shoot to cover that burden with 30% or less of their income.

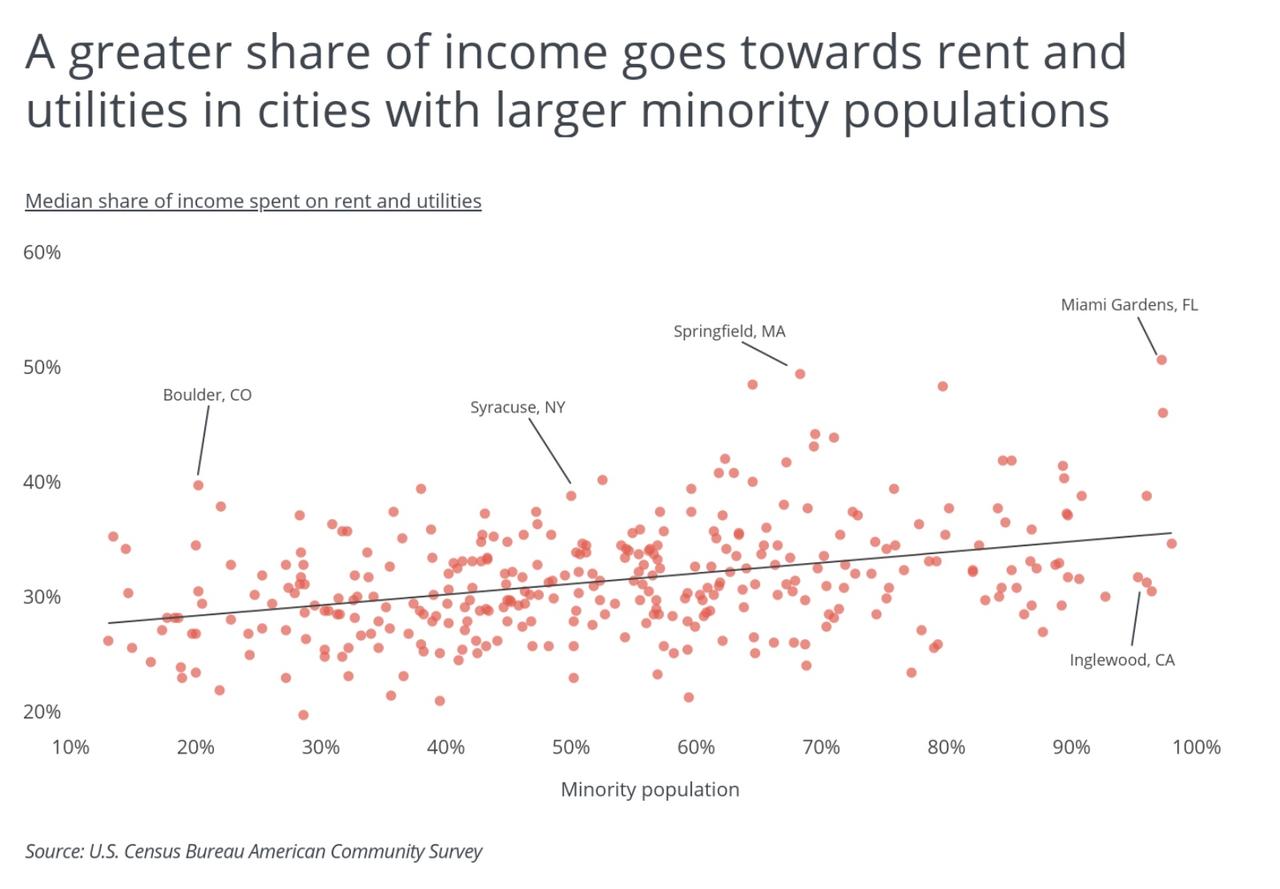

One of the study’s findings is that cities with larger minority populations tend to see residents paying a higher share of their income in rent.

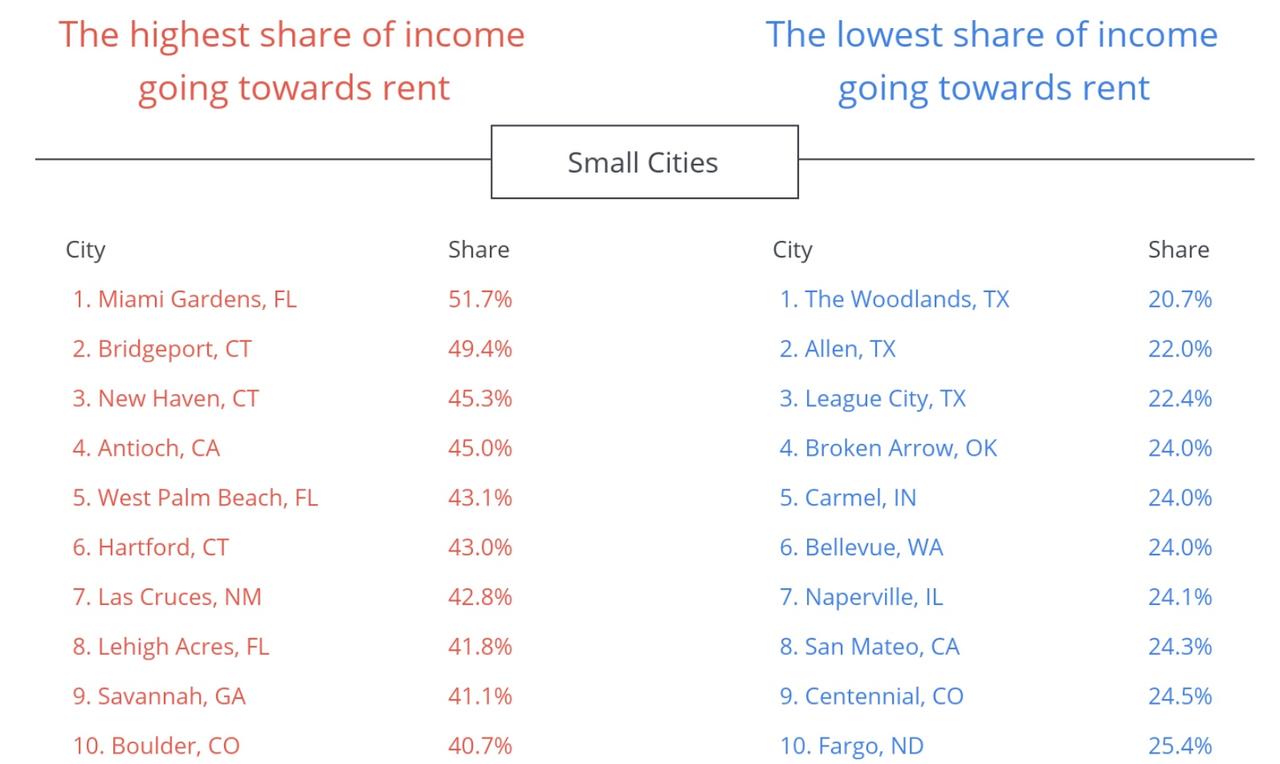

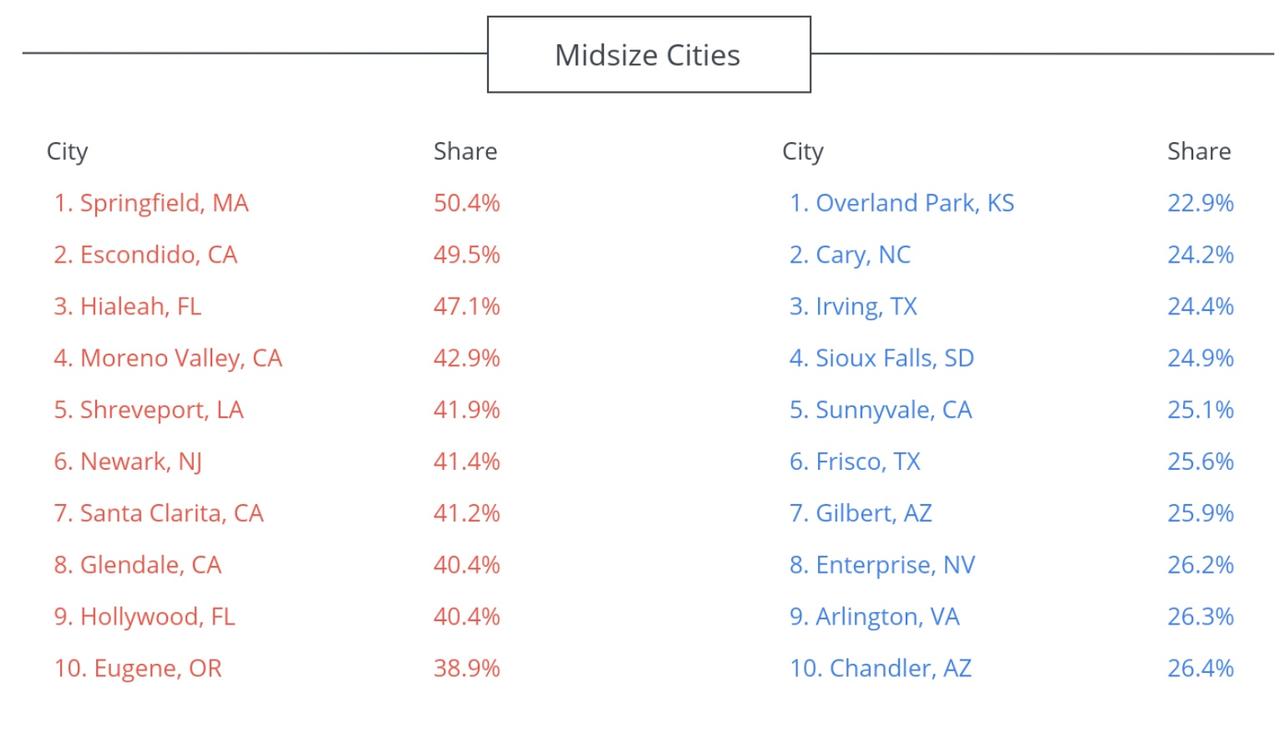

When it comes to the overall rankings, researchers used a ream of Census data to divide cities into three categories, small, medium and large.

In the ‘small cities’ category, Miami Beach had the highest rent-to-income ratio, and Woodlands, Texas had the lowest.

In the ‘Midsize Cities’ category, Springfield Mass. was No. 1, while the cheapest went to Overland Park, Kansas.

On the ‘Large Cities’, the top-place finisher for highest rent-to-income ratio was, surprisingly to some, New Orleans, Louisiana, where the median number was 44%.

In San Francisco, the city with the lowest rent-to-income ratio, that number was just 22%.

By looking at the median figures from this study, we can gain some insight into how industry can transform property values, and how many in San Francisco who earn more than the median income are still living pretty comfortably, unless they have a veritable mountain of student debt.

See the rest of the rankings here.

Source: Zero Hedge

Image: Pixabay