By Colin Lloyd

By Colin Lloyd

Over the period from 1915 to 2014 the return on U.S. equities was an annualized 11.5 percent, while the return on government bonds averaged 4.3 percent. The longer-run average S&P 500 return is nearer 9 percent, but during the past decade it has exceeded 14 percent. U.S. bonds have also rallied, returning around 2 percent. Yields across most developed countries have fallen to record lows, with the 10-year obligations of Germany, Japan, and Switzerland (among others) offering a negative nominal yield to maturity.

Despite their lower long-run return, the great advantage of bonds and other fixed-income securities, relative to equities, is that they pay, assuming there is no default, regular interest in the form of coupons. For pension funds and other institutions, which need to maintain a steady stream of payments to their plan beneficiaries, these coupons allow the cash flows from assets to match liabilities. Equities, by contrast, may or may not pay dividends (which, in any case, are often variable), and that uncertainty is compounded by the tendency of equity markets to rise and fall, at times dramatically.

Setting aside their inherent volatility, equities have proved an outstanding inflation hedge. Fixed-income securities pay a stream of fixed coupons, and then, at maturity, the principal is repaid to the investor. Equities, unlike most bonds, are, hopefully, perpetual investments. They do not mature at a fixed date in the future; instead, they give the investor a stake in the performance of a business over time. If the price of the goods that a firm sells should rise, all other things equal, equity investors benefit as higher prices are reflected in the profitability of their investment. Retained profit increases the capital value, while higher dividends increase income.

Back in the 1960s, as inflation crept into developed economies, the price of goods and services rose. Central banks responded by raising short-term interest rates. Confronted by this headwind, fixed-income investments performed poorly, and capital values declined. This led some investment managers into temptation. In order to keep pace with inflation over the long run, they invested an increasing share of their assets in equity markets.

While this was a good long-term solution to the problem of inflation, it left pension fund managers exposed to a cash flow shortfall. The variable income from dividends (especially during an inflationary recession) did not always cover the costs of meeting their obligations to pensioners; the unpalatable solution was to meet these cash flow requirements by liquidating assets.

Deflation and debt

So what does all this have to do with the negative interest rates seen in many bond markets today? Well, the problem of the mismatch between the cash flow from assets and that from liabilities prompted a deluge of prudential regulation to ensure that pension funds were able to fulfill their obligations to their customers. The politically popular solution was to mandate that pension funds invest a substantial percentage of their assets in cash or liquid securities, such as fixed-income government bonds.

Today most developed countries are grappling with the demographic challenges of an aging population and low fertility rates. Pensioners are living longer, and the working-age population is shrinking. For governments that provide public pensions, this is a near and present danger, since they pay their pension obligations from current tax receipts. The shortfall between tax receipts and public pension obligations will continue to rise.

The funding problem for private sector pension funds should be more manageable. Employees (and their employers) pay regular contributions. Pension funds should, by this method, accumulate sufficient assets to meet future obligations.

Sadly, there is a catch: these pension funds are obligated to invest a significant percentage of their assets in fixed-income government securities. While these bond investments produce a positive inflation-adjusted return, all is relatively well; as soon as their yields dip below the level of inflation, trouble begins to brew.

There may be trouble ahead

Today, if you are a “lucky” employee, you may be enrolled in a “defined-benefit scheme.” On maturity this scheme will pay you a fixed percentage of your final salary (or some variation on that measure) in the form of a pension. If you are a less “lucky” worker, your company scheme will be a “defined-contribution scheme.” This will invest your contributions (and contributions made by your employer) into assets that will, hopefully, generate sufficient returns to ensure you can receive a steady stream of income in retirement.

“And there’s the rub”: most central banks target inflation of around 2 percent, as a direct result of quantitative easing; however, many of their own governments’ bonds yield less than that inflation rate. This is not so true in the U.S., but it is absolutely the case in Switzerland, Japan, and much of the Eurozone. In this environment, pension fund managers should, for prudential reasons, forsake bonds in favor of higher-yielding assets; and yet, their fiduciary duty is at odds with their domestic regulatory requirements to keep a high percentage of assets in liquid cash, near-cash, and fixed-income securities.

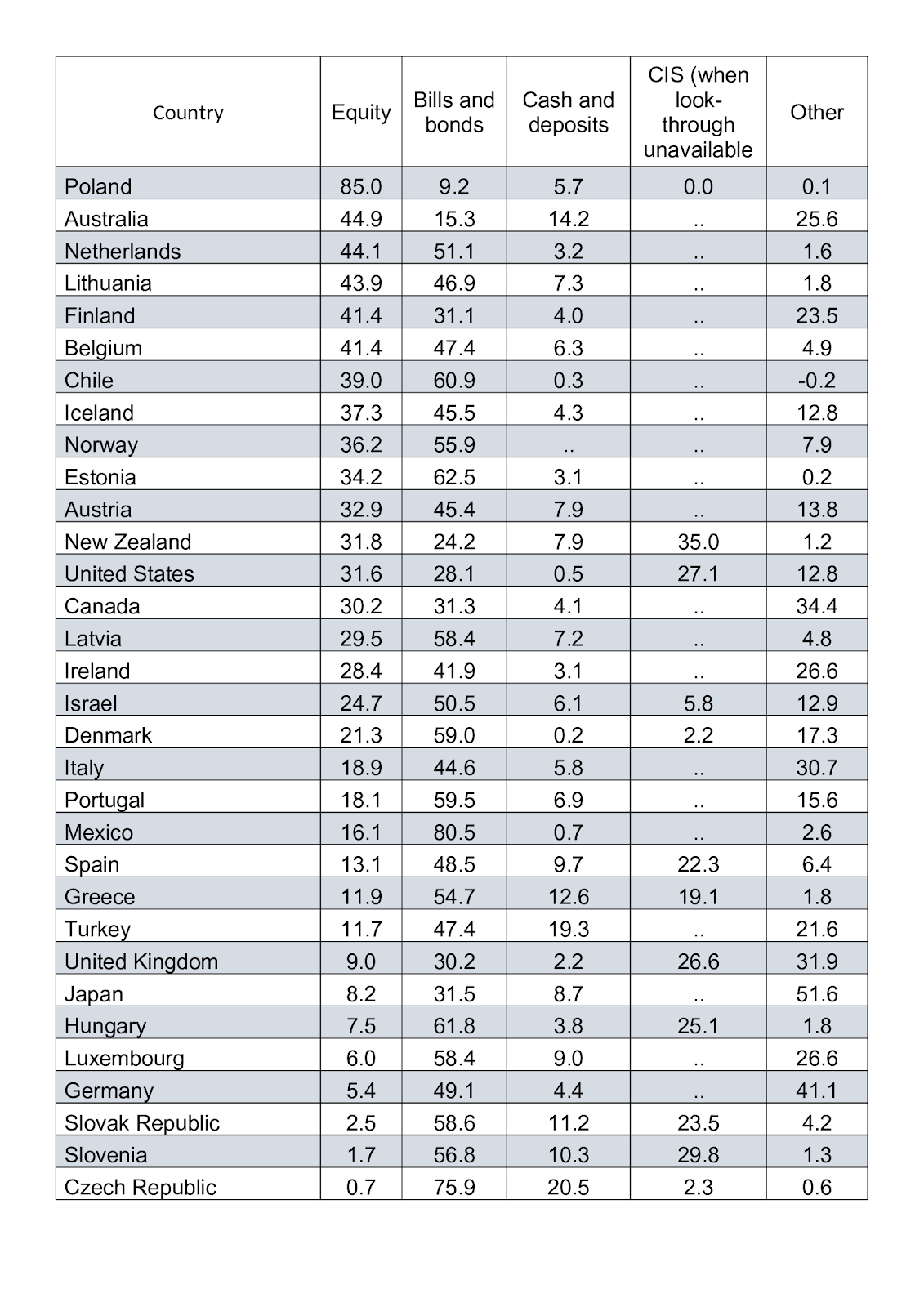

How much government paper fund managers are obliged to hold varies from country to country; the rules are complex. A more useful guide is to be found in the table below. Taken from the 2018 OECD Pension Fund Survey, it shows the breakdown of investments by country and asset class.

According to other OECD data, 12 out of 34 reporting countries saw pension fund assets decline between 2017 and 2018, with total assets declining by 3.9 percent. Back in February 2018, Citibank estimated that the funding shortfall for the 20 largest economies in the OECD was $78 trillion, around 1.8 times the GDP of those countries. In January 2019, Swiss Re estimated that the funding shortfall across the OECD was increasing by around 5 percent per annum, meaning that the underfunding liability could swell to $400 trillion by 2050.

In real terms, stocks have returned more than seven times as much as bonds over the 1915–2014 period. We know that inflation averaged 3.2 percent; nonetheless, bonds managed to produce a positive real return of 1.1 percent versus a real return from equities of 8.3 percent.

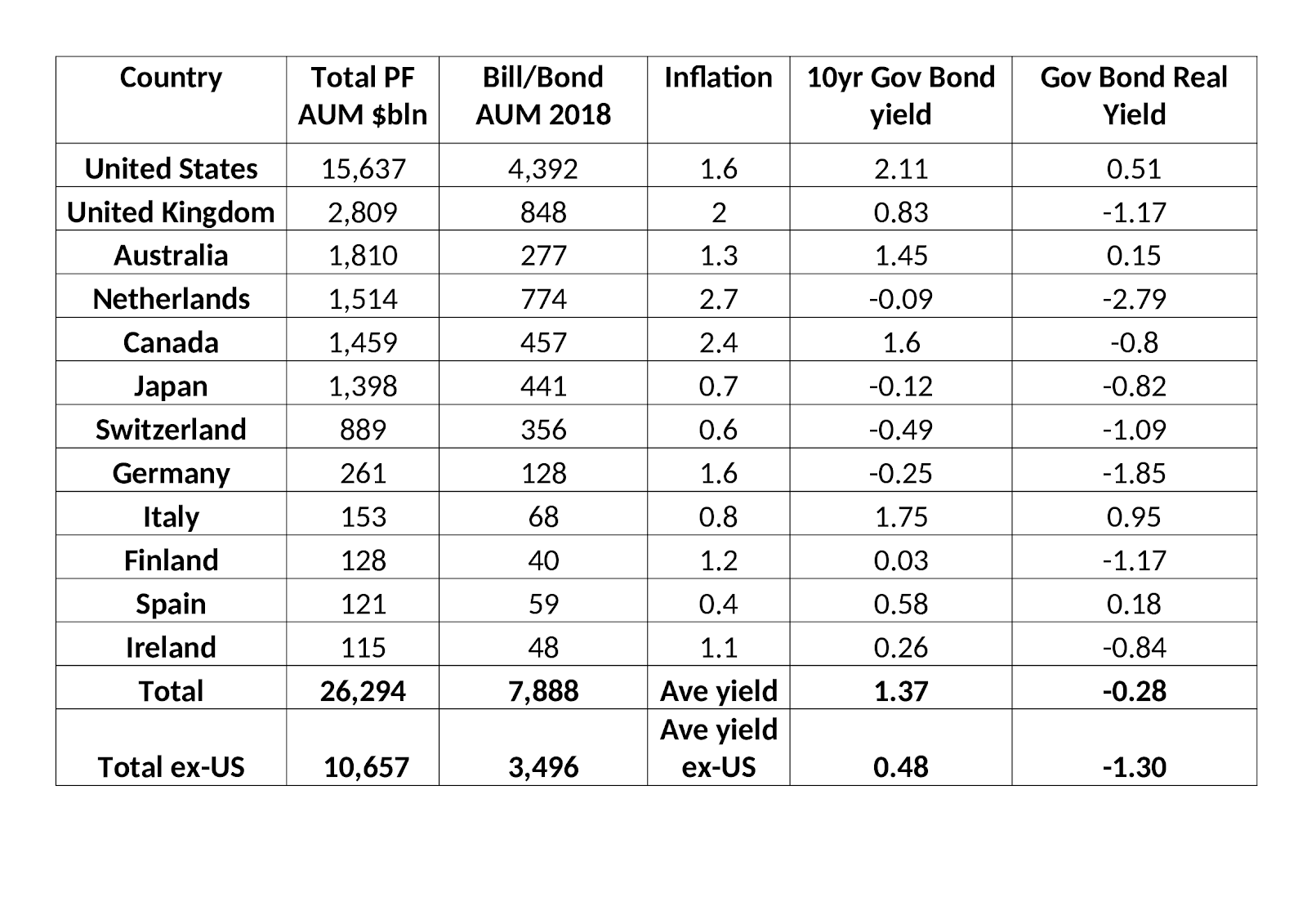

An analysis of current government bond yields and inflation shows a very different picture. The table below, which focuses on the assets under management (AUM) of the pension funds (PFs) of the top 12 OECD countries (amounting to 95 percent of the OECD total) shows the weighted-average yield using 10-year bond yields from July 12, 2019.

The table is overly simplistic; please forgive ridiculous assumptions, such as the idea that the pension assets of each country are invested only in bonds of 10 years’ maturity, or that those bonds are of their own country alone. I further assume that current yields and inflation rates prevail for the next 12 months, arriving at a weighted-average nominal bond yield of 1.37 percent, and a real yield of −0.28 percent. Remove U.S. pension assets from the table, and the weighted nominal yield falls to 0.48 percent while real yields dip to −1.30 percent.

Pension Fund Target Returns

While pension fund managers have adjusted their target returns downward over the past two decades, the average expected return remains above 6 percent per annum. A classic 60 percent/40 percent portfolio of stocks and bonds has delivered 8.3 percent over the 1915–2014 period, so a 6 percent target might be considered conservative. Nonetheless, with bond yields delivering less than half their long-run average, pension fund managers are confronted with a dilemma. They can increase their equity allocation in order to meet their long-term return objective, but this creates solvency-risk issues since they may have to liquidate equity-capital investment at low valuations in order to meet their income obligations.

There are alternatives: They can invest in higher-yielding, but more volatile, long-dated bonds, or in higher-yielding, higher-risk bonds of less creditworthy issuers; or they can allocate to alternative investment strategies such as private equity or hedge funds. All of these options (with the exception of certain hedge fund strategies) increase investment and liquidity risk.

The inertial alternative, which has been the choice of the majority of funds, is to continue underperforming, hoping for a reversion to long-run average rates of return. Minimum-funding rules differ from country to country but generally permit a cyclical period of underfunding to last for around seven years. This allows pension funds to meet their near-term obligations by borrowing from future returns.

A cyclical dip in fixed-income returns can be tolerated on the grounds that interest rates will normalize. In the post–financial crisis environment, however, low interest rates are now the norm, and quantitative easing has caused long-dated yields to become artificially depressed. Unless interest rates are permitted to normalize, the underfunding gap will widen far more quickly. Swiss Re assumes a 5 percent annual shortfall, taking the developed-country pension fund deficit to $133 trillion within a decade. If we assume the shortfall is a more severe 7 percent, the underfunding deficit balloons to $164 trillion, roughly twice the size of world GDP today.

Negative-yielding bonds are a relatively new phenomenon, and a normalization of interest rates may be in the offing. If so, bond and stock prices will fall substantially and the world economy will head into a debt-laden recession. If, as I expect, central banks avert the near-term crisis by keeping interest rates artificially low and continue to expand their balance sheets by the purchase of their governments’ obligations, they are, in the long run, impoverishing their own people.

All they have contrived is to defer the day of reckoning. Solutions are available, but none are politically palatable; meanwhile the misallocation of capital could drive the trend rate of economic growth inexorably lower.

Colin is a macroeconomic commentator, writer and presenter, based in London, England. He has worked for asset managers in commodities, money markets, capital markets, equities and foreign exchange since the early 1980’s and writes In the Long Run. He is a contributor to several free-market publications including The Cobden Centre and was a 2017 runner-up for the 2017 Richard Koch Breakthrough Prize awarded by The Institute of Economic Affairs.

This article was sourced from AIER.org